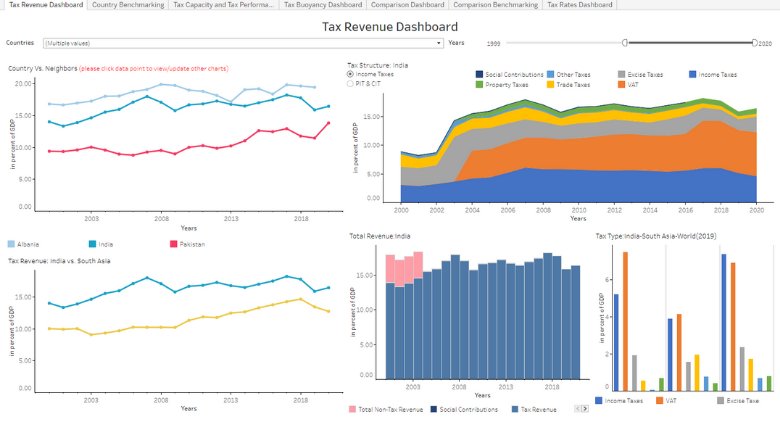

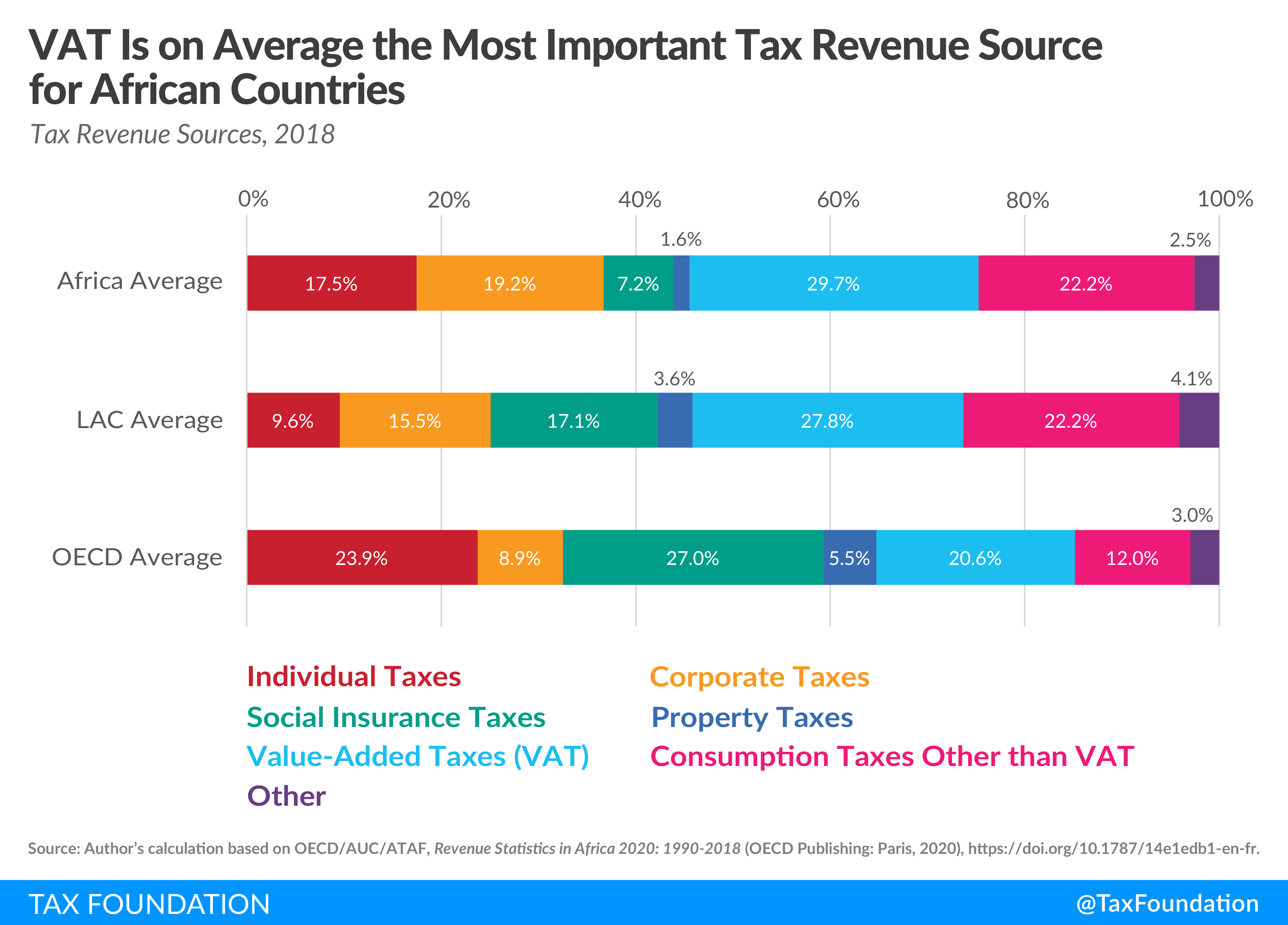

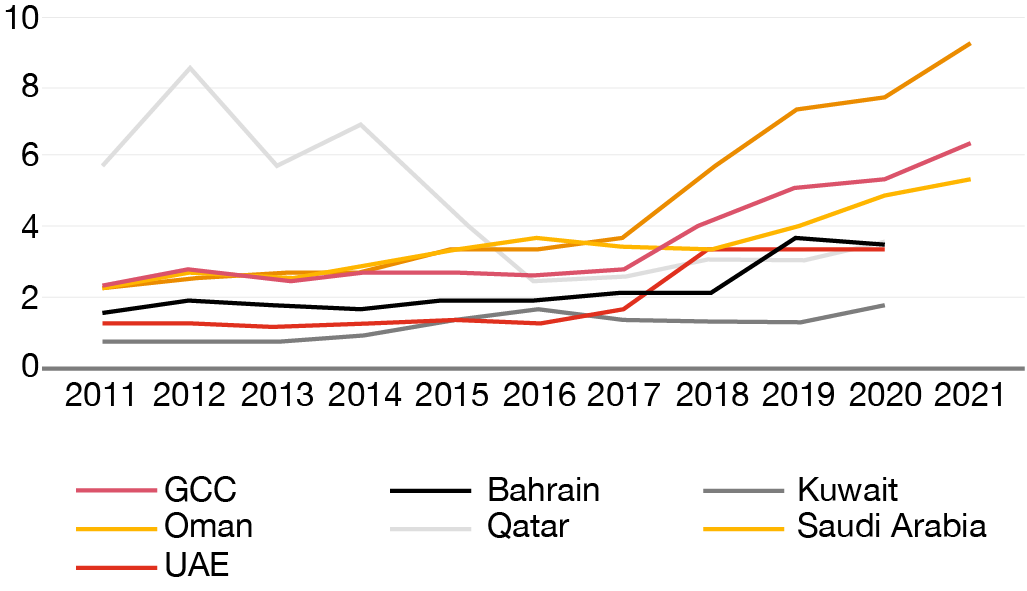

From no tax to low tax: as the GCC relies more on tax, getting it right is critical for diversification - PwC Middle East Economy Watch

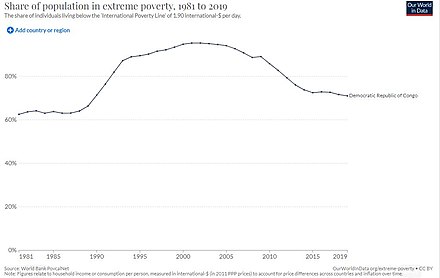

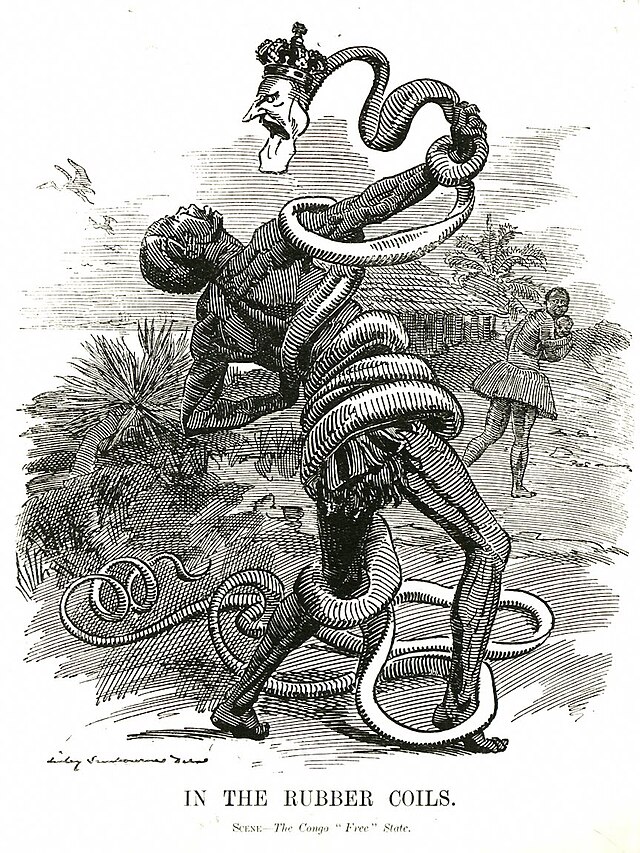

The Participation Dividend of Taxation in DRC and Beyond: Recent Evidence and Paths for Future Inquiry – ICTD

No participation without taxation? Evidence from randomized tax collection in the D.R. Congo: Guest post by Jonathan Weigel

The Indigenous World 2022: Democratic Republic of the Congo (DRC) - IWGIA - International Work Group for Indigenous Affairs

Dancing in the Glory of Monsters: The Collapse of the Congo and the Great War of Africa: Stearns, Jason: 9781610391078: Amazon.com: Books